Halal investing made simple

Our halal investments are structured in accordance with the strictest Islamic principles

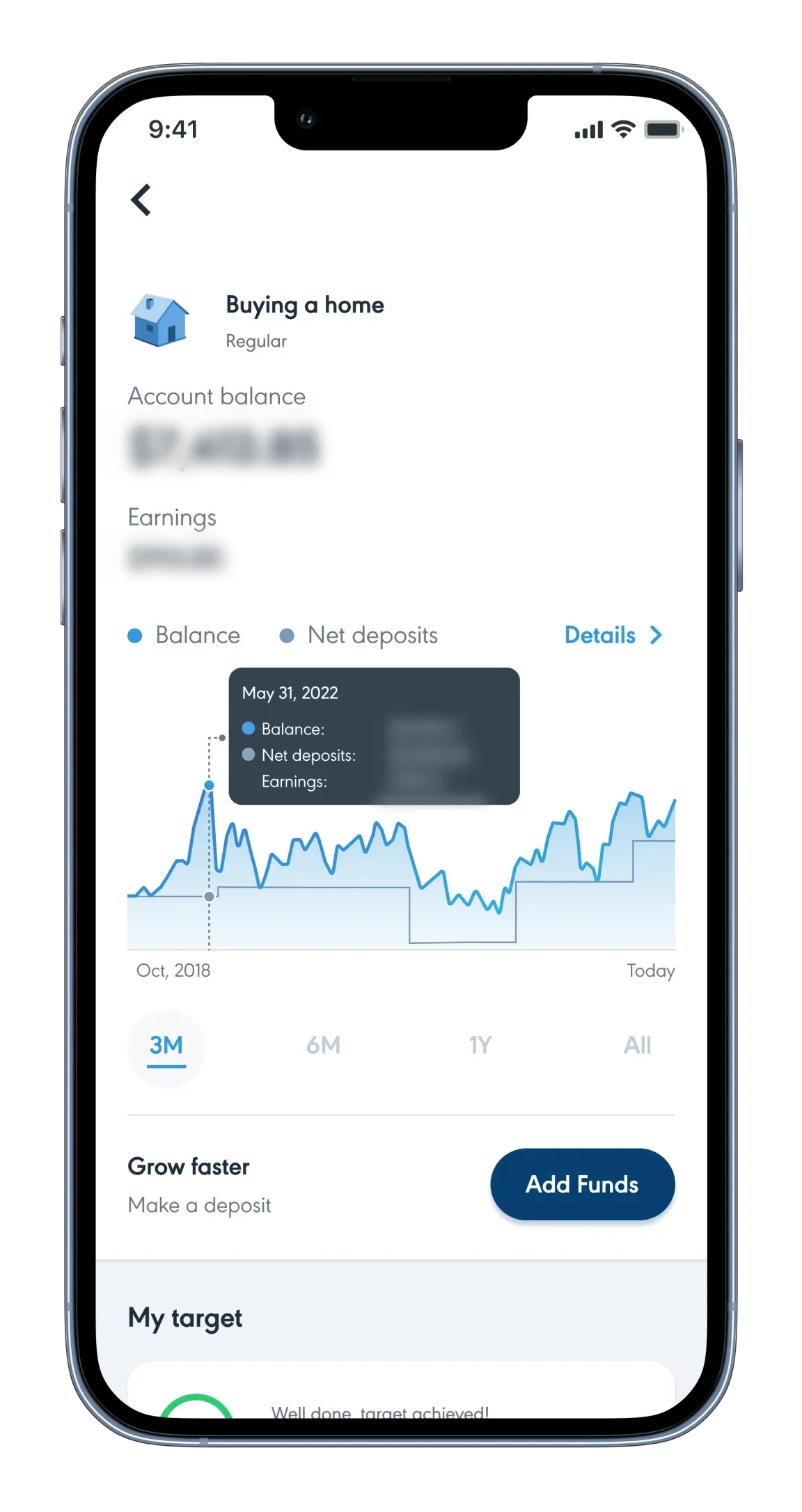

For illustrative purposes only, not actual performance. Past performance is not indicative of future results. See terms and condition for full disclosures.

*

Join the 300,000+

people investing with Wahed

Gold standard app

Our halal investments are structured in accordance with the strictest Islamic principles

Low investment

minimum

minimum

High speed

digital experience

digital experience

Withdraw funds

at any time

at any time

Your risk,

your control

your control

Strictly Shari'ah

Our halal investments are structured in accordance with the strictest Islamic principles

Quality

Performance

Our halal investments are structured in accordance with the strictest Islamic principles

For illustrative purposes only, not actual performance. Past performance is not indicative of future results. See terms and conditions for full disclosures.

*

join the fight against Riba

Start your journey to wealth

Our halal investments are structured in accordance with the strictest Islamic principles